Data released at the end of Tuesday showed the Utama India’s main retail inflation rate, measured by the Consumer Price Index (CPI), soaring to the highest of 17 months 6.95 percent in March. While inflation is seen increasing, the extent to which the increase is far more than expected.

But more than just being the highest in 17 months, CPI inflation is now included in the Reserve Bank of India (RBI) medium-term target for the 30th month in a row. The last time inflation came below 4 percent was the way back in September 2019.

But what drives this latest price increase?

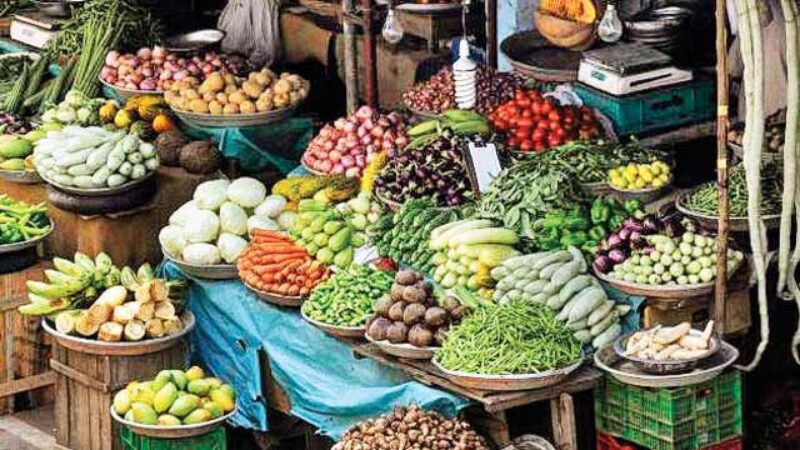

Food prices rise far more than expected in March. According to the Securities Bank of America, food inflation was responsible for 70 basis points of increasing CPI inflation, from 6.07 percent in February to 6.95 percent, in March.

To understand the buildup Press sequential prices and not entangled in any basic effect, we must see the consumer food price index, which jumped 1.4 percent month to month in March – the first sequential increase in four months.

Looking back on the pandemic period, the consumer food price index has risen the month to month 14 times, decreasing on 10 occasions, and still has not changed once.

Not surprisingly, most of the biggest inflation drivers are food. Of the top five sub-groups with the highest month rise in the month of their index in March, four related to food: oil and fat, meat and fish, fruits, and spices. Fifth is personal care and effects, which include items such as soap, women’s sanitary napkins, and certain services, including barber people and beauticians, among others.

But as indicated by fruits, the price increase in the month (2.5 percent) does not always mean high inflation (2.54 percent). At the other end of the spectrum are vegetables. While vegetable inflation almost doubled to 11.64 percent in March from February 6.06 percent, the vegetable index actually decreased by 1.6 percent on month to month.

The pandemic period has seen core inflation – inflation does not include food components and volatile fuel – still increasing for a prolonged period. The most basic form of core inflation, calculated by uniting four large groups – 1) paan, tobacco, and liquor 2) Clothing and footwear 3) Housing 4) Others – rose to 6.4 percent in March, calculations made by MoneyControl Show.

While economists like to improve the size of this core inflation further and delete certain individual items, the RBI has historically see this broad definition. And the main component of this is a ‘miscellaneous’ group, which accounts for 28.32 percent of all CPI baskets and includes goods and services that make up some discretionary demand.

In March, other inflation rose to a nine-month high of 7.02 percent. Last time below 6 percent on May 2020. Last time it was under 4 percent in November 2019.

The bottom line, however, is the main inflation rate and the RBI fulfills its mandate. Failure for the RBI (MPC) Monetary Policy Committee will mean CPI inflation coming out of the range of 2-6 targets for three consecutive quarters. While this happens in the past – CPI inflation is above 6 percent in the fourth quarter 2020 – it is not a failure because the national locking imposed contains a pandemic in April-May 2020 means that the data for two months is incomplete. .

MPC treats the final numbers arriving in two months as a break in the series. However, the specter of failure has maintained his head again. RBI estimates 6.3 percent inflation for April-June and 5.8 percent for July-September. With CPI inflation averaged 6.3 percent in the first quarter of 2022, it would be a close call for the level setting panel.