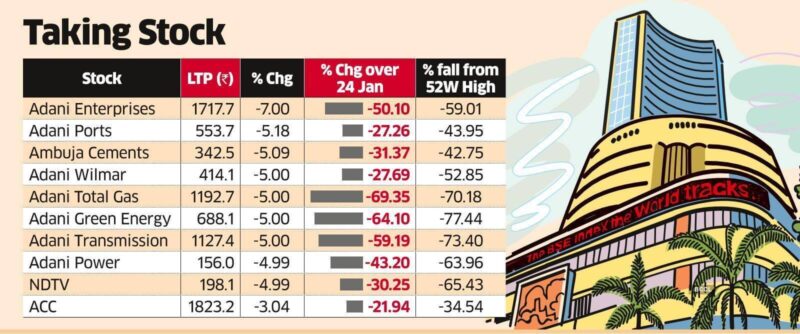

A month has passed since short seller Hindenburg Research on January 24 warned investors of 85 per cent potential downside in Adani group stocks, citing sky-high valuations. As it is turning out, three of group names Adani Total Gas, Adani Transmission and Adani Green Energy are close to breaching that mark.

Shares of Adani Total Gas hit another 5 per cent lower circuit in Thursday’s trade at Rs 793.25 and are now down 79.58 per cent from its January 24 closing of Rs 3,885.45 level. This stock has not settled higher even for a single day during this period.

Adani Green Energy hit its 5 per cent lower circuit limit at Rs 512.35. At this price, the renewable energy stock is down 73.22 per cent over its January 24 closing of Rs 1,913.55. This scrip has ended higher in just two of the sessions since Hindenburg allegations.

Shares of Ahmedabad-headquartered Adani Transmission hit one-year low at Rs 749.35 in Thursday’s trade. This scrip is down 72.81 per cent over its January 24 closing of Rs 2,756.15. This stock has ended higher only twice since January 24.

Hindenburg Research, which held short positions in Adani Group companies through US-traded bonds and non-Indian-traded derivatives, along with other non-Indian-traded reference securities, had a few successful shorts in the past. In September 2020, it made short positions in electric vehicle company Nikola and talked about lies and deceptions by Nikola in the years leading up to its proposed partnership with General Motors. Nikola Founder and Executive Chairman Trevor Milton promptly resigned from the company.

On its website, Hindenburg said: “The story garnered attention from mainstream international media, featured in the Wall Street Journal, Financial Times, CNN, Barron’s and CNBC, among others. Both the SEC and DOJ are reported to have investigations into the company following the report.”

Its report on Adani group titled “How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History” too generated media attention in India and abroad, even as the group kept denying Hindenburg’s allegations.

While Hindenburg claimed it took it two years to come out with the Adani group investigation, its report came at a time when Adani Enterprises was gearing up for India’s largest ever follow-on public offer. Adani group later withdrew the issue, citing market volatility that made shares of Adani Enterprises falling sharply below the issue price, even before the FPO shares were distributed to investors.

Hindenburg in its report posed 88 questions to the Adani group. The scathing report made Gautam Adani losing $107 billion in wealth so far. He is now 29th richest against 3rd one month ago. His group stocks have lost over Rs 11 lakh crore in market value since Hindeburg’s report.

Adani Group CFO Jugeshinder Singh, who was among speakers on Day 2 of Kotak Chasing Growth – 2023 Conference, said his group prepared the response on 88 Hindenburg Research allegations within two days.

Singh said the first day was utilised to ensure that the claims are tested. Singh said the group’s infrastructure portfolio was fully ring-fenced and rating agencies re-affirmed the same within 24 hours.

On the Day 2, audit committees that Singh said were 100 per cent independent went through board meetings and completed all audits. He asserted that nobody will find anything untoward in the nine companies that he looks after.