Introduction

Harshad mehta bull run rajkotupdates news : few names evoke as much intrigue and fascination as Harshad Mehta. The story of his meteoric rise and subsequent fall during the bull run of the late 20th century continues to captivate both financial enthusiasts and casual observers. This article delves into the saga of the Harshad Mehta bull run, exploring its roots, the Rajkot connection, and the lasting impact it had on India’s financial landscape.

Also read : https://thebusinessdays.com/us-inflation-jumped-7-5-in-in-40-years-rajkotupdates-news/

The Origins of the Bull Run

Early Life and Aspirations

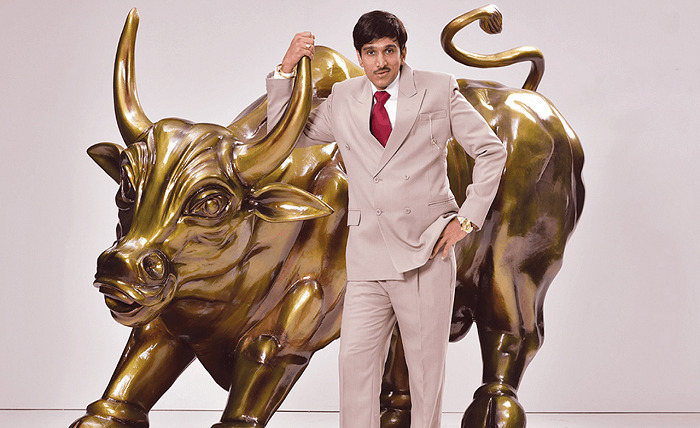

Harshad Mehta, born in a humble family in Rajkot, had ambitious dreams of achieving significant financial success. From his early years, he exhibited a keen interest in the stock market and a drive to excel in the world of finance.

The Stock Market Dynamo

Mehta’s journey from a small-time broker to a stock market maven was marked by his strategic understanding of market dynamics. He recognized the potential of tapping into the banking system to manipulate the stock prices, eventually leading to what came to be known as the “Harshad Mehta Scam.”

The Rajkot Connection

Linking Back to Roots

Mehta’s Rajkot connection remained a pivotal aspect of his life. Despite his relocation to Mumbai for better opportunities, Harshad mehta bull run rajkotupdates news : his connection to his hometown remained strong, and he maintained relationships with individuals in Rajkot.

Ripple Effects on Rajkot

The reverberations of Mehta’s financial activities were felt far beyond the financial centers. Rajkot, the place where he had spent his formative years, experienced both direct and indirect impacts due to the repercussions of the bull run.

Impact on India’s Financial Landscape

Market Volatility and Regulatory Reforms

The bull run orchestrated by Mehta led to unprecedented market volatility, exposing the vulnerabilities of the Indian financial system. The subsequent regulatory reforms aimed to fortify the system against such manipulations in the future.

Investor Sentiment Shift

The aftermath of the scam altered investor sentiment, creating a sense of caution and skepticism in the market. The trust deficit took years to rebuild as market Harshad mehta bull run rajkotupdates news : participants grappled with the consequences of Mehta’s actions.

Evolution of Financial Journalism

The Harshad Mehta bull run also highlighted the importance of robust financial journalism. Media played a pivotal role in uncovering the intricate details of the scam, prompting a renewed emphasis on investigative reporting within the financial sector.

Conclusion

rajkotupdates news : Harshad Mehta’s bull run stands as a testament to the complex interplay between ambition, market dynamics, and regulatory oversight. It left an indelible mark on India’s financial landscape, reshaping market practices, and emphasizing the need for transparency and accountability.

FAQs

-

What was the Harshad Mehta Scam?

- The Harshad Mehta Scam refers to the fraudulent stock market manipulation orchestrated by Harshad Mehta in the 1990s, involving the misappropriation of funds from the banking system.

-

How did the scam impact Rajkot?

- While Rajkot was Harshad Mehta’s hometown, the scam’s effects were felt indirectly through itsHarshad mehta bull run rajkotupdates news : impact on the national financial system, leading to increased regulatory scrutiny and market volatility.

-

What were the lasting reforms after the bull run?

- The aftermath of the bull run prompted significant regulatory reforms aimed at bolstering transparency, accountability, and integrity within India’s financial markets.

-

What role did media play in uncovering the scam?

- Media played a crucial role in exposing the intricate details of the scam, leading to increased awareness and highlighting the significance of investigative financial journalism.

-

How did investor sentiment change after the scam?

-

The scam eroded investor trust and led to a shift in sentiment, with investors becoming more cautious and vigilant about market practices and potential scams.