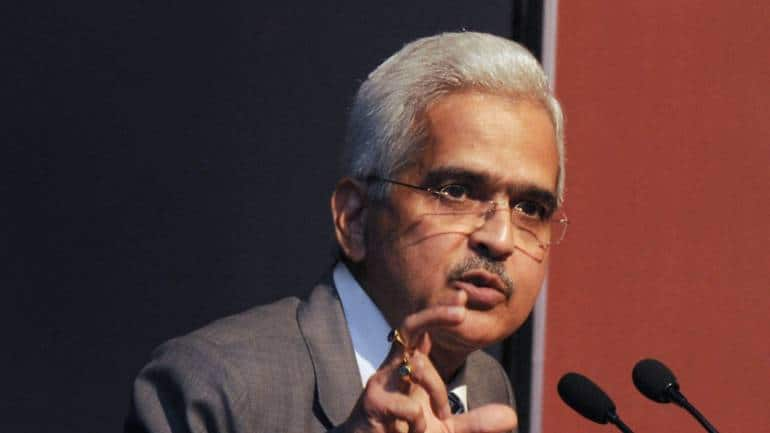

The battle between perception and establishing expectations is not an easy one. And Governor Shaktikanta Das may be losing the battle following the Reserve Bank of India’s latest monetary policy decision.

The central bank chief was at pains to emphasise that the Monetary Policy Committee’s decision on April 6 to leave the repo rate unchanged at 6.5 percent as against market expectations of a 25-basis-point hike was for “this meeting only” and was not an indication of what might happen in the future.

We want to drive home the point that this is a pause in this meeting. Don’t take it as a pause for several meetings in the future,” Das said in the post-policy media briefing having earlier noted that the RBI’s job is “not yet finished” and the war against inflation would continue until it was closer to the 4 percent target on a durable basis.

From the look of it, Das has not convinced many people.

we believe the window for hikes has closed,” said Rahul Bajoria, head of EM Asia (ex-China) economics at Barclays. “As such, we no longer expect any further rate hikes from the MPC in 2023-24. We think only a material upside surprise keeping CPI inflation above 6 percent for a long period would warrant another rate action by the MPC.”

Consumer Price Index inflation is seen averaging 5.2 percent this year – well below the 6 percent upper-limit of the central bank’s tolerance range.

Ahead of the MPC’s decision, only a few central bank watchers thought there was a case to pause the rate hike cycle. But the tide seems to have decidedly turned in their favour.

A snap poll by Moneycontrol showed that as many as 14 of 20 economists think the MPC will now be on an extended or prolonged pause with regard to interest rates. Two economists think the committee has entered a data-dependent or wait-and-watch mode, while four economists see the possibility of the repo rate being hiked by 25-50 basis points in the coming months.

Enough (tightening) might just be enough was the overarching message from the RBI,” noted Aurodeep Nandi, India Economist at Nomura.

The RBI has indeed tightened monetary policy by a fair bit. The repo rate was increased by 250 basis points in 2022-23, with Das keen to emphasise the impact of the introduction of the Standing Deposit Facility in April 2022, which lifted the bottom of the Liquidity Adjustment Facility corridor by 40 basis points.

These increases have been fully transmitted to the overnight weighted average call money rate… which has gone up from daily average of 3.32 percent in March 2022 to 6.52 percent in March 2023. It is now necessary to evaluate the cumulative impact of these rate hikes,” Das said.

The market, however, is not buying the MPC’s commitment to act again in the future “should the situation so warrant”.

A key factor behind the MPC’s decision to not hike the repo rate for the seventh time in less than 12 months is seen to be the financial sector concerns that have erupted in the US and Europe. The issue had already forced the Reserve Bank of Australia to make no change to its cash rate of 3.6 percent earlier this week.

These problems are also expected to lead to tighter financial conditions, which would be an additional headwind for the global economy,” the central bank said on April 4, adding that the Australian banking system is strong, well capitalised, highly liquid, and “well placed to provide the credit that the economy needs” – all of which was also reiterated by the RBI on April 6.

A pivot of monetary policy would actually be the change of stance from withdrawal of accommodation to neutral, which RBI may possibly be able to telegraph once better clarity emerges on monsoon performance,” QuantEco Research’s economists said in a note.

The ‘stance’ is another headache, given that the MPC has altered its language to say that it will remain focused on withdrawal of accommodation “to ensure that inflation progressively aligns with the target”. Previously, the resolution said the MPC would remain focused on withdrawal of accommodation “to ensure that inflation remains within the target going forward”.

What is known is that the ‘stance’ is, in practical terms, controlled by the RBI – the manager of liquidity – rather than the MPC. So it is perhaps better to focus on the policy rate. And central bank watchers are pretty sure the rate hike cycle has ended.