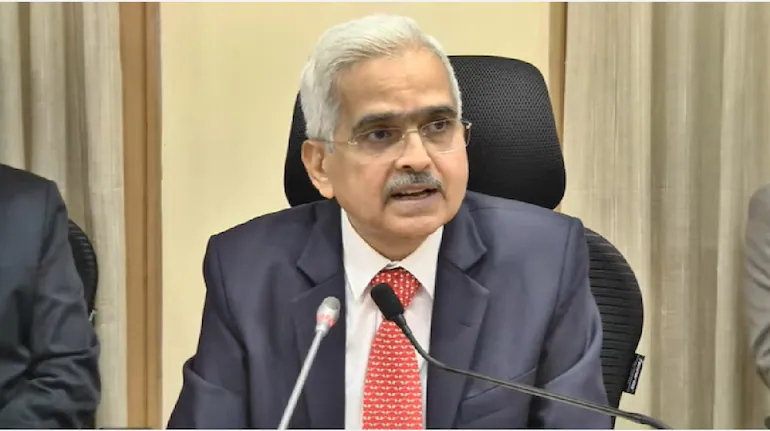

The main part of an extraordinary external commercial loan (ECB) from India is effectively protected, the Governor of the Central Bank said on July 22.

ECB is a loan available by Indian entities from lenders who are not residents or foreign. Most of these loans are provided by foreign commercial banks and other institutions.

From the ECB circulating at $ 180 billion, 44 percent or $ 79 billion, not collected, Das Shaktikanta said that quoting the latest financial stability report for June released by the Reserve Bank of India (RBI).

Das explained that this unspecified exposure includes around $ 40 billion in public sector companies, especially in the oil, train and electricity sectors. It has assets with “natural hedging characters,” he said.

In addition, becoming a public sector entity, the risk of their foreign exchange, if any, can be absorbed by the government, said the Governor, adding that this possibility is “very unlikely.”

The remaining $ 39 billion unteasperated exposure represents 22 percent of the total ECB circulating, Das said. This includes borrowing companies that have income in foreign currencies, he added.

It is important to see what is called forex exposure that is not determined in the “correct context, said the Governor.

Watershed comments emerged after the rupee violated an important psychological level of 80 dollars per dollar and had fallen to the lowest lowest position. Increased global crude oil prices, widening trade deficits, expectations from aggressive US reserve federals and large foreign outflows have maintained dollar well offers, keeping rupees under pressure.

In such a scenario, currency value protection by importers and borrowers of foreign loans has increased further suppressing the exchange rate of the rupees, according to forex experts. Through a currency value, investors try to reduce the effects of currency fluctuations in investment. Because importers and borrowers of foreign loans need dollars to make payments abroad, there is a tendency to protect at the current level, assuming Rupees will be further depreciated.