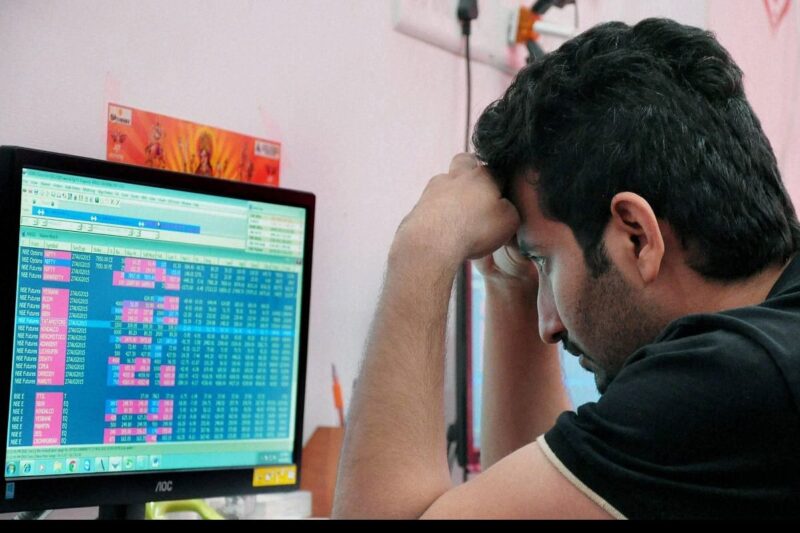

Equity benchmarks start the last week of the quarter with rear legs, extending losses for the fourth successive session, tracking the atmosphere of risk among investors who lead to unrelenting pressure on global stocks due to increased inflation fears and global recession continues to increase.

The NSE NIFTY index fell under 17,000 points and BSE Sensex dropped more than 1,000 points when the bloodshed in the market was extended from Friday. Rupee reaches the lowest point of all time on Monday, marks the lowest session of the third record that was violated.

Although India is seen as a bright spot at times of global slowdown, the domestic market will not be fully isolated from foreign chaos and will continue to see intra-day volatility attacks,” said Prashanth Tapse, senior vice president for research in Mehta Equity.

Among the 30-Share Sensex Packages, Power Grid, Tata Steel, Maruti, Mahindra & Mahindra, NTPC, Indusind Bank, Axis Bank and Titan are the main slow in early trade.Nestle and Hindustan Unilever are the only acquisition.

On Friday, Sensex fell more than 1,000 points, and NSE closed 1.7 percent lower, with a selling pressure that caused erosion of more than ₹ 4 lakh crore in investor wealth.

According to the initial data of the National Stock Exchange, foreign institutional investors (FII) sell Indian stock worth 29 billion rupees on Friday.

Because of Fed’s move, a lot of money coming to a developing country will return,” Saubh Jain, Assistant Vice President for Research at SMC Global Securities, told Reuters.

The increase in interest rates in the United States and aggressive policy attitudes by the Federal Reserve forced a dozen of other countries to do so last week, underline the risk of global economic slowdown which has caused attacks due to endless sales in global equity.

Then this week, the Reserve Bank of India will also raise interest rates, but with how many policy observers are widely separated.

When investors race to follow the projection of the US Federal Reserve interest rates, Asian shares are limping to the fourth weekly loss on Friday, and bonds suffered significant losses.

The global stock index reaches the lowest position of the new year, and shares in Japan and Australia fall. Futures in US and European shares declined.

We are in a period of global glory, with pessimism covering various countries for different reasons,” Ed Yardeni, President of his Epolymous research firm, who warned the growing clouds of storms for the US economy, told Bloomberg.

The latest data with our growth recession scenario, but the risk of full recession clearly increases,” he wrote in a Monday note.